Rumors circulating about shorting USDT and USDC? Let's explore the details | Tokenview

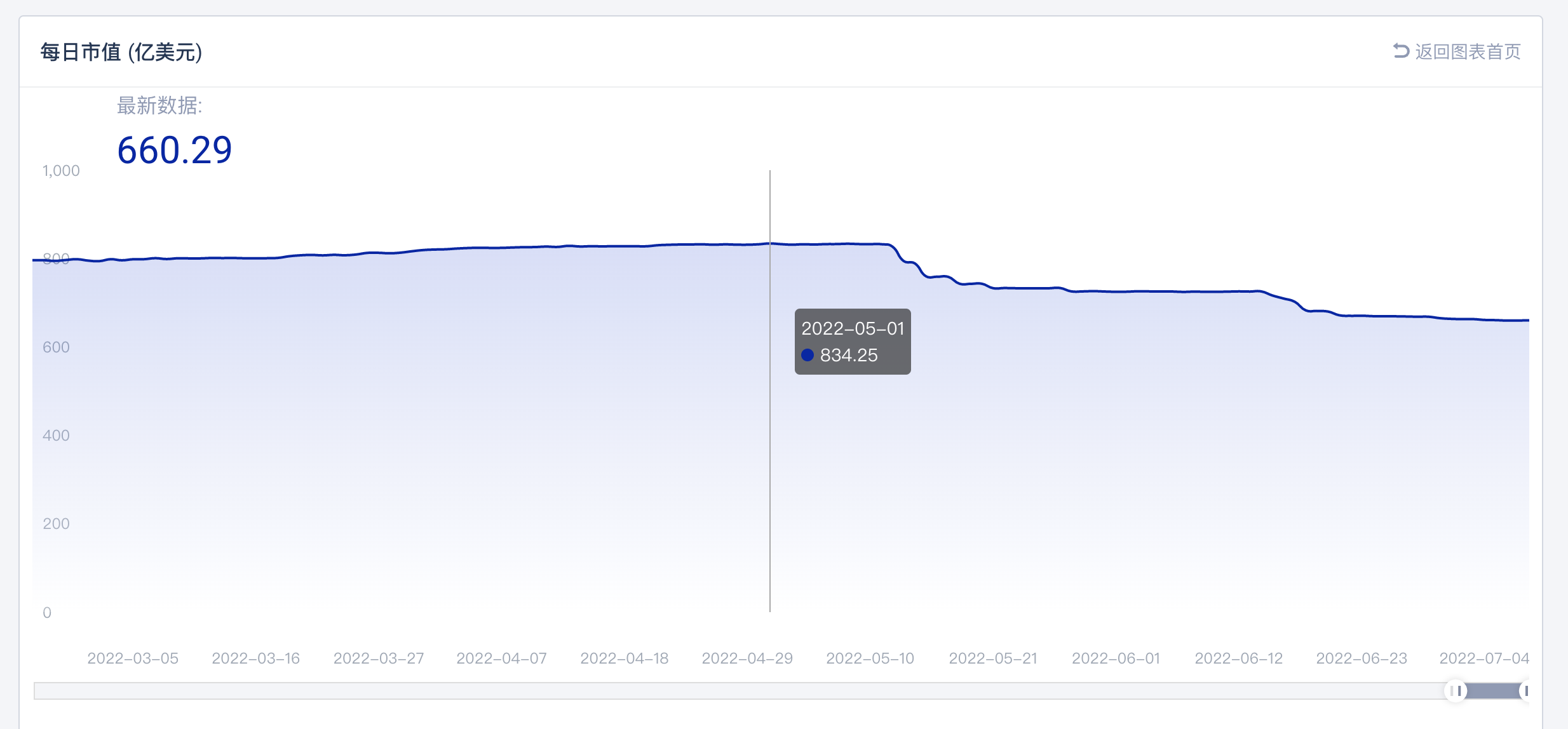

USDT is the largest stablecoin in the cryptocurrency market, with its value pegged 1:1 to the US Dollar. According to Tokenview USDT Browser data (https://usdt.tokenview.io), as of July 7, 2022, the market capitalization of USDT remains at approximately $66 billion.

Last week, The Wall Street Journal interviewed Leon Marshall, the sales director of cryptocurrency broker Genesis Global Trading. Marshall mentioned that many traditional hedge funds are contemplating a large-scale shorting of USDT, involving hundreds of millions of dollars. Following this news, FUD sentiment towards USDT instantly surged in the market, with more and more people joining the ranks of shorting USDT.

In fact, this is not the first time that USDT has faced such widespread panic. As early as 2018, it was revealed that the actual assets pledged to support USDT were less than the market value of circulating USDT. This led to a decline in trust in USDT, and people began selling USDT in the market, causing the USDT price to drop and briefly decouple from the US Dollar.

In 2019, data released by Tether, the issuer of USDT, showed that 74% of USDT was backed by cash, notes, and equivalents. This means that there was 26% of USDT in the market without corresponding reserve funds as collateral. In the event of a USDT default, this 26% of USDT might not be able to be redeemed in a timely manner. This news once again caused panic in the market, leading to continuous selling of USDT and creating a negative premium.

In May of this year, with the explosive incident of the stablecoin UST on the Terra blockchain, influenced by market trends and emotions, the cryptocurrency market began to experience a selling frenzy. More and more traditional hedge funds started shorting USDT.

These hedge funds shorting USDT can be summarized into the following two main reasons:

1. Not optimistic about the future of cryptocurrencies.

With the continuous escalation of inflation, the Federal Reserve is gradually resorting to measures such as raising interest rates to curb and mitigate the impact of inflation. The reduction of available liquidity in the market will lead investors away from high-risk investments, including cryptocurrencies. The overall enthusiasm and liquidity in the cryptocurrency market are expected to gradually weaken predictably.

2. Distrust towards the Tether institution itself.

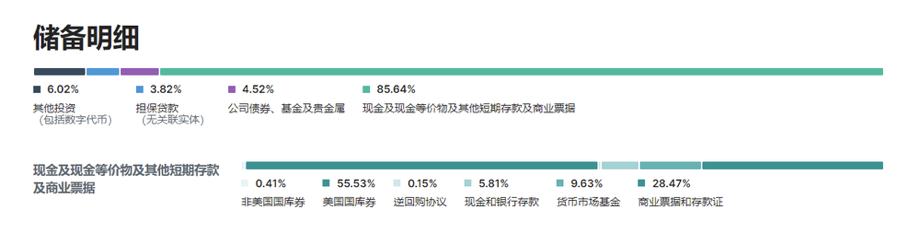

USDT claims its value is pegged 1:1 to the US Dollar based on the premise of having sufficient collateral reserves. These reserves include assets such as cash, bonds, commercial paper, and bank loans. Some institutions believe that, based on Tether's previous reserve information, the adequacy of the collateral reserves is still to be verified. For example, in 2021, Tether and Bitfinex were accused and fined $18.5 million for misrepresenting their reserves. Additionally, some short-selling institutions believe that most of the commercial paper held by Tether comes from heavily indebted real estate developers.

Since briefly decoupling from the US Dollar in May, the market capitalization of USDT has been consistently decreasing. According to Tokenview data, the market capitalization of USDT has fallen by approximately $17.4 billion since May.

However, during the same period, the market capitalization of the stablecoin USDC issued by Circle and Coinbase increased by 8.27%, reaching its highest level of $55.9 billion on July 2nd. The market capitalization ratio between USDT and USDC is close to 1.18, marking the smallest difference in market capitalization between USDC and USDT since the birth of USDC.

Similar to USDT, USDC is also a stablecoin pegged to the US Dollar, with a 1:1 peg, meaning 1 USDC equals 1 USD. For every 1 USDC purchased, Circle stores 1 USD in a designated bank (Silvergate Bank) and mints the corresponding USDC for the user. Unlike USDT, USDC has consistently emphasized compliance and transparency as its core strengths. The issuer of USDC, Circle, holds payment licenses in the United States, the United Kingdom, and the European Union, as well as the BitLicense from the state of New York. It is one of the companies with the highest number of global licenses in the cryptocurrency industry, providing compliant channels for the inflow and outflow of cryptocurrencies in USD, GBP, and EUR. Coinbase, another issuer of USDC, is one of the cryptocurrency exchanges with the most regulatory licenses globally.

Market sentiment indicates that since the collapse of Terra in May, cryptocurrency investors have become increasingly cautious about stablecoins. The leading stablecoins, USDT and USDC, have inevitably faced bearish views from some short-selling institutions. However, due to Tether's lack of public disclosure on asset reserves and regulatory matters, investors are generally more concerned about the possibility of a collapse of USDT. As the bearish trend on USDT intensifies, investors are more inclined to exchange USDT for USDC for storage. This is because, compared to USDT, USDC has clearer judicial supervision and institutional endorsement, making the likelihood of a collapse event extremely low.

Given the heightened market panic, Jeremy Allaire, the founder and CEO of Circle, made a series of statements on Twitter. He expressed that Circle has been collaborating with regulatory agencies, top-tier custodians, and leading financial institutions. The company remains committed to transparency and trust, and will continue to strengthen reporting and disclosure through simple, clear, and frequent updates.

This statement undoubtedly serves as a morale boost for cryptocurrency users. According to Tokenview's on-chain data monitoring, the liquidity of USDC on Uniswap reached a near 18-month low on July 3rd, totaling $186,154,314.42. This suggests that the panic short-selling activities related to USDC in the market are gradually diminishing, providing reason to believe that USDC will tend towards stability in the future.

Let's talk about USDT again. Will USDT experience a severe detachment event similar to what happened with Terra's UST?

In fact, with the experience of UST, we can see that if a stablecoin experiences a severe collapse, most of the reasons are due to the loss of market trust and difficulties in large-scale selling/redemption. UST is an algorithmic stablecoin that relies solely on market behavior to adjust anchoring, which seems to be relatively fragile. In a situation where the market is generally cold, investors are easily influenced by the 'herd effect,' making trading behavior uncontrollable. On the other hand, USDT, as a collateralized stablecoin, has cash, notes, bonds, and other assets as collateral, making it relatively more stable and reliable.

On May 19th, the latest quarterly assurance opinion from Tether indicates that, compared to the current 8.4 billion commercial paper assets held by Tether, 5 billion of these paper assets will mature on July 31st. Once matured, it means that the amount of Tether's commercial paper holdings will significantly decrease to a low point of 3.5 billion, aligning with Tether's commitment to the community. The ultimate goal remains to bring this number down to zero. Although commercial paper and treasury reserves are typically considered liquid assets and cash equivalents, the proportion of U.S. Treasury holdings in Tether reserves will now be larger.

On the other hand, Tether has never experienced a case of redemption failure, meaning that you can exchange USDT for fiat currency at any time. Large-scale redemption is impossible for widely-used USDT in various applications. As a well-established stablecoin deeply integrated into the crypto community and serving as a bridge between the crypto and traditional financial realms, USDT plays a crucial role, ranking just below BTC and ETH. If a severe default event were to occur with USDT, it would impact the entire crypto community. Therefore, in the face of the short-selling crisis surrounding USDT, Tether, as the central entity, has responded to this event.

On June 27th, Paolo Ardoino, the CTO of Tether, clarified the panic statements about USDT through a tweet, stating that Tether has been collaborating with regulatory authorities to enhance transparency. The company is gradually reducing the purchase of commercial papers, shifting towards acquiring U.S. Treasury bonds, and improving settlement efficiency.

A female spokesperson for Tether also stated, 'Hedge funds are creating opportunities for shorting by spreading rumors,' and they will not provide further comments on this matter.

Everyone has different opinions on whether there will be a catastrophic event for USDT and USDC. However, it cannot be denied that, with the overall cooling of the cryptocurrency market, USDT and USDC will inevitably be affected by external factors such as market sentiment. For stablecoins, enhancing credibility and transparency, further strengthening redemption security, and expanding use cases are now more urgent considerations.

APIs

APIs

Back

Back