DEFI 2.0: Liquidity Upgrade? | Tokenview

DEFI History

What is DEFI (Decentralised Finance),It actually refers to a decentralized protocol used to build an open financial system, which aims to allow anyone in the world to conduct financial activities anytime, anywhere.

The emergence of Ethereum laid a solid foundation and created necessary objective conditions for the development of DeFi. What development has DEFI experienced?

- In 2014, Danish entrepreneur Rune Christenson initiated the Ethereum-based MakerDAO project. This is widely regarded as the first DeFi project in Ethereum and even the entire blockchain field. This project allows users to borrow and lend a digital stable currency pegged to the U.S. dollar with a specific token (Token) as collateral.

- Subsequently, a series of DeFi projects that simulate traditional financial services such as ETHLend (later renamed Aave) and Compound appeared on Ethereum.

- In June 2020, Compound Finance, a DeFi project based on Ethereum, opened a token reward model: rewarding users who provide digital asset loans to project applications and users who lend digital asset loans from applications. COMP has both equity and value attributes.

The incentive method is more colloquially called ‘yield farming’ or ‘liquidity mining’, which is translated into Chinese and collectively referred to as “liquidity mining”.

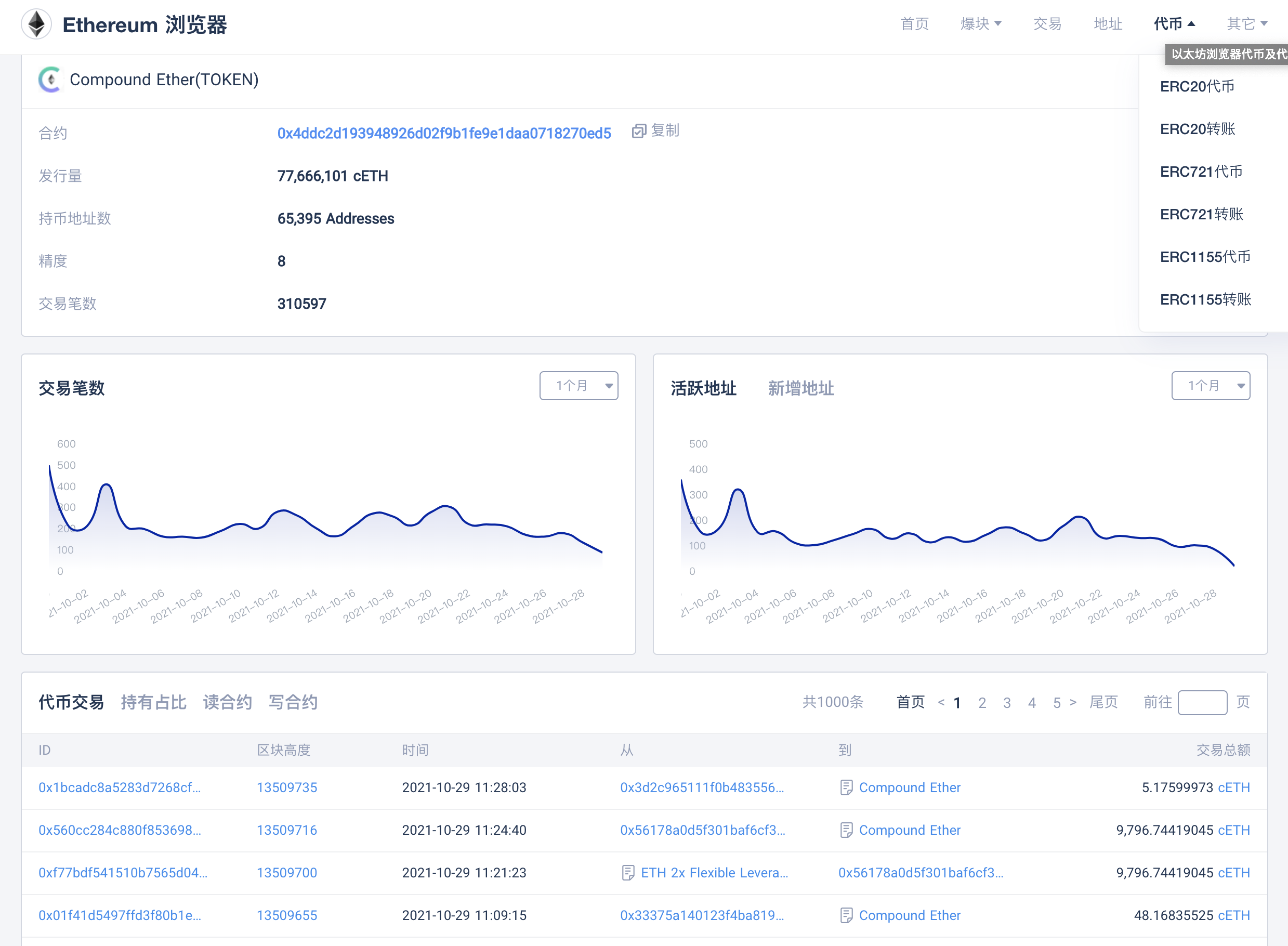

Tokenview ETH Explorerexplore all ERC20, ERC721, ERC1155 token information.

What is DEFI 2.0? What trends can it bring?

In addition to the underlying public chain infrastructure such as Ethereum, the most important reason why DeFi can become DeFi is the provision of liquidity. Short-term incentive models will only encourage short-term behavior of liquidity providers. The issuance of additional tokens enters the hands of liquidity providers. In many cases, liquidity providers have not formed a long-term mutually beneficial cooperative relationship with the agreement.

The next bull market led by the Defi 2.0 project depends on their own ability to mainstream cryptocurrencies. For protocols and platforms, the most important thing is to provide the best solution. For example, there is no need to pay high gas fees and wait for a long time for transaction confirmation when interacting on the Ethereum network.

The key to the new generation of projects in DEFI 2.0 is to reduce non-permanent losses, promote the development of the lending market, and directly govern operations. Then the DEFI project side needs to focus on optimizing TVL and creating healthy cash flow. Capital efficiency is the need for DEFI 2.0 to focus on optimizing.

DeFi 2.0 essentially completes the infrastructure layer of DeFi

DeFi's infrastructure includes not only public chains such as Ethereum, but also basic Lego blocks such as DEX, lending, and derivatives. It also includes the liquidity that supports these models. Liquidity itself is also an important sustainable infrastructure layer for DeFi.

Introduction of 3 projects based on DEFI 2.0

Abracadabra Money

- Market Cap: $1.79B

- Price: 0.025$

- Exchange: FTX, Uniswap

Abracadabra Money is a protocol that allows users to use liquid assets such as yvUSDT and xSUSHI as collateral to borrow a stable currency called MIM (Magic Internet Money). SPELL tokens serve the governance role of the ecosystem and bring rich returns through staking.

The platform allows users to freely adjust the proportion of collateral to improve capital efficiency and returns. Not only that, MIM tokens can also serve as decentralized stablecoins, which are superior to their peers in terms of practicality and multi-chain compatibility.

Mortgage stablecoins, such as MakerDAO, use assets such as ETH, USDC and USDT as collateral to issue stablecoins. However, if people use the yvUSDT obtained by pledging USDT with xSUSHI in Yearn or Sushi as collateral, they can get deposits or pledge rewards, and they can also get loans. In other words, the liquidity and efficiency of assets are maximized.

In addition to improving the utilization of funds, it also reduces the possibility of liquidation. Because these mortgage assets will add value. This is a type of innovation based on user needs.

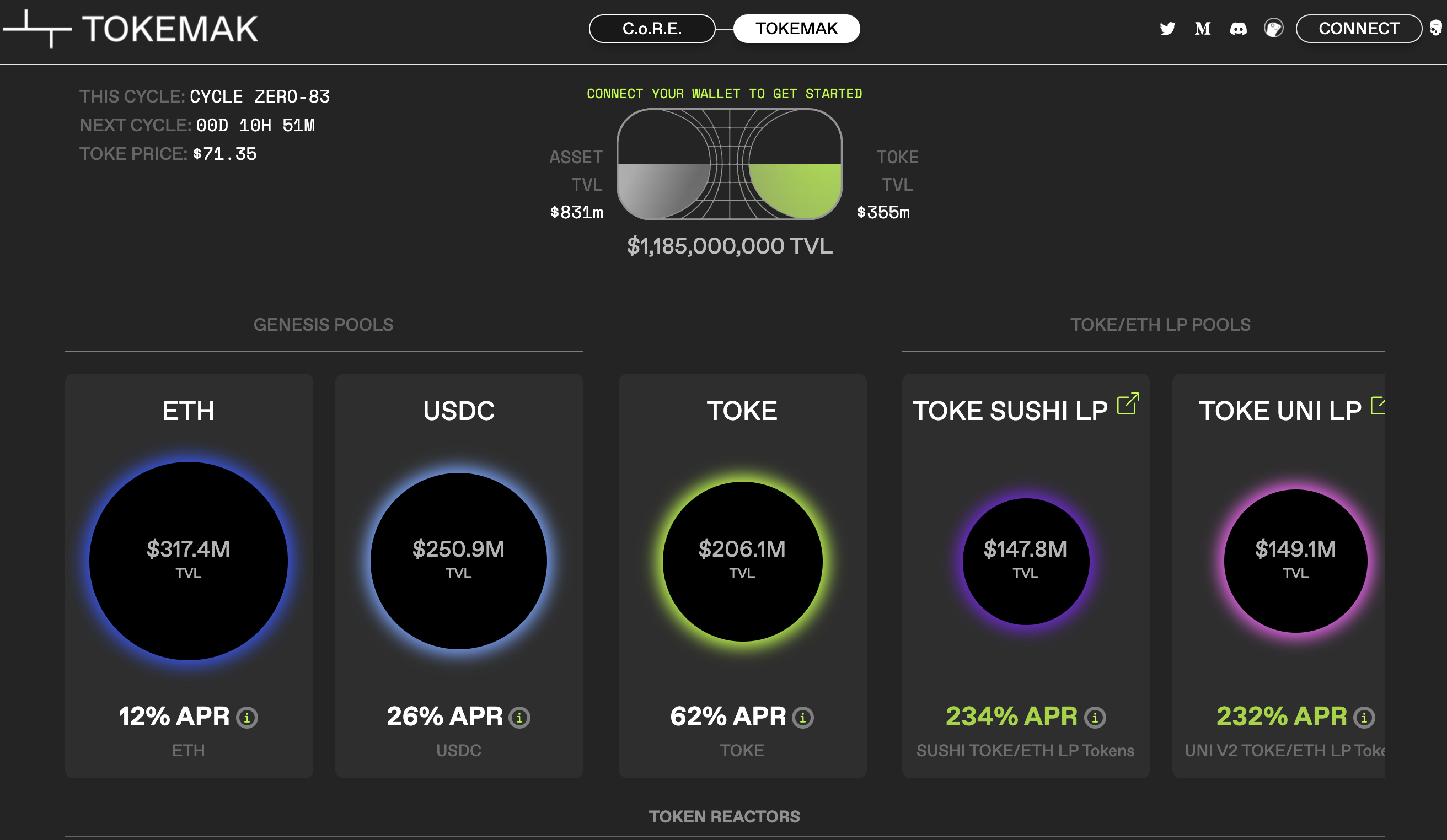

Tokemak

- Market Cap: $1.18B

- Price: 71.50$

- Exchange: SUSHI, Uniswap

Tokemak is a decentralized market maker and liquidity provider operated by DAO.

On the TokeMak protocol, it can collect various idle tokens, and participants can provide unilateral tokens, including tokens such as ETH and DAI, as well as tokens for different protocol projects. These tokens can be formed into token pairs to provide liquidity. Each token asset has its own 'reactor' (when a liquidity provider deposits a token asset, it will get a corresponding amount of TOKE assets, which can be redeemed 1:1). TokeMark's protocol token TOKE acts as a guide to liquidity, and can also be understood as tokenizing liquidity. TOKE controls the flow of liquidity.

Strips Finance STRP

- Market Cap: $15.1M

- Price: 7.05$

- Exchange: Gate, Uniswap

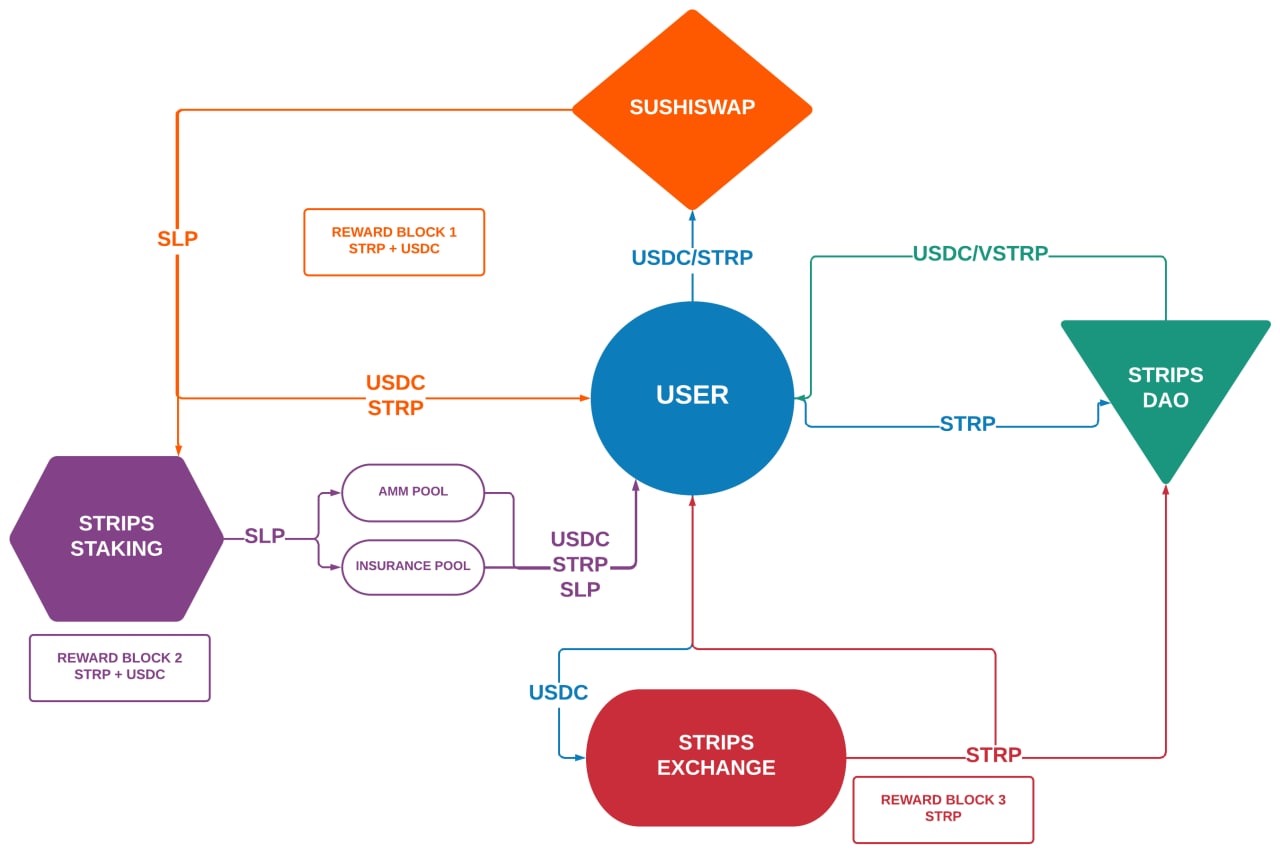

Strips' goal is to be the largest stable income trading platform. The so-called 'stability' is to convert floating interest rates into fixed interest rates through hedging and other methods, thereby locking in income. The first DeFi product launched by Strips was the 'Interest Rate Swap System' (IRS) built on Ethereum.

Strips not only introduced the concept of traditional financial interest rate swaps into the blockchain, but also created a 'perpetual interest rate swap' system and set up 1-10 times the leverage, through which users can hedge interest rate gains for interest rate arbitrage.

APIs

APIs

Back

Back